When it comes to financial matters, credit scores play a crucial role. In this article, we will delve into the intricate details of credit scores, providing you with a comprehensive analysis.

Understanding the nuances of credit scoring is vital for making informed decisions about loans, mortgages, and other financial ventures. So, let’s embark on this journey to demystify credit score and equip you with the knowledge you need.

What Are Credit Scores?

Credit scores are numerical representations of an individual’s creditworthiness. They provide lenders with an assessment of the likelihood that a borrower will repay their debts. Credit scoring models evaluate various factors and generate a score that reflects an individual’s credit risk. Understanding the components that contribute to credit score is essential for comprehending their significance.

Importance of Credit Scores

Credit scores are pivotal in the financial landscape, influencing numerous aspects of our lives. Lenders heavily rely on credit score when evaluating loan applications. A high credit score can unlock opportunities for favorable interest rates and higher borrowing limits. On the other hand, a low credit score can impede access to credit or result in unfavorable loan terms.

Factors Affecting Credit Scores

Several factors contribute to the calculation of credit score. These factors include payment history, credit utilization, length of credit history, types of credit, and recent credit inquiries. Understanding how these elements impact your credit score will help you manage your finances more effectively.

Types of Credit Scores

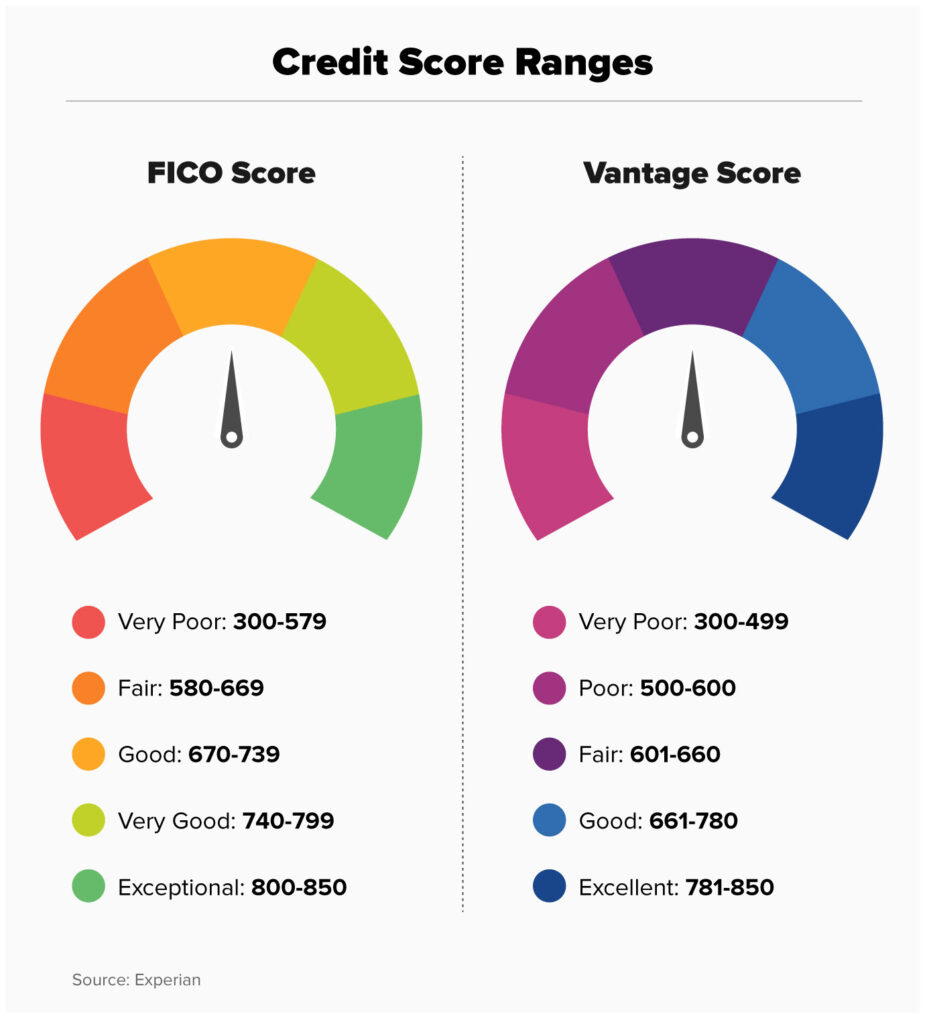

Various credit scoring models are utilized by different entities. The most commonly known is the FICO Score, which is widely used by lenders. VantageScore is another model gaining popularity. Being aware of the different scoring models will provide you with a more comprehensive understanding of your creditworthiness.

Understanding Credit Score Ranges

Credit score typically fall within a range, indicating different levels of creditworthiness. Understanding these ranges will allow you to assess your standing and take appropriate steps to improve your score. Ranges may vary depending on the scoring model, but the general concepts remain similar.

How to Improve Your Credit Score

If you have a less-than-ideal credit score, don’t worry. There are several proactive measures you can take to enhance it. Timely payment of bills, reducing credit utilization, maintaining a diverse credit mix, and avoiding unnecessary credit inquiries can positively impact your credit score in the long run.

The Impact of Credit Scores on Loans and Interest Rates

Lenders assess credit scores to determine the level of risk associated with lending. Higher credit scores often result in lower interest rates and better loan terms. Conversely, lower credit score may lead to higher interest rates or even loan rejection. Understanding this correlation will help you make more informed borrowing decisions.

Monitoring Your Credit Score

Regularly monitoring your credit score is essential to stay updated on your financial health. Monitoring services and credit bureaus offer tools to track your score, identify discrepancies, and detect potential fraud. By keeping a vigilant eye on your credit score, you can address any issues promptly and maintain good financial standing.

Common Credit Score Myths Debunked

There are numerous misconceptions surrounding credit score. It’s crucial to debunk these myths and separate fact from fiction. Common myths include the belief that checking your credit score lowers it or that closing a credit card improves your score. By understanding the truth behind these myths, you can make better financial decisions.

Conclusion

Credit scores wield significant influence over our financial lives. By comprehending the intricacies of credit scoring, you empower yourself to make informed decisions and take proactive steps to improve your creditworthiness. Remember, a strong credit score opens doors to better loan opportunities and financial stability. Stay vigilant, manage your credit responsibly, and reap the rewards of a healthy credit profile.